Brooklyn Space December 20, 2023

Photo: Totem

Ambitious mixed-use plan for affordable housing, new retail, and public open spaces begins environmental review

Totem, a Brooklyn-based real estate development firm specializing in innovative design and community-driven projects, marked the next milestone in its plan to transform a privately-owned 94,000 square foot site at Broadway Junction into Herkimer-Williams, a mixed-use hub. The proposal is centered on delivering new fully permanent affordable housing, public open space, retail, commercial and industrial space, and increased opportunities for workforce development.

A public hearing this week at the New York City Department of City Planning formally kicked off the environmental review process that will study the project and its impact over the next several months. Upon completion, Herkimer-Williams is intended to serve as a mixed-use economic development generator that can create new opportunities to help improve the quality of life for East New Yorkers. Construction would take place over a 10-year, phased approach toward a four-building complex that delivers approximately:

- 600 permanently affordable housing units.

- 120,000 square feet of community facility space.

- 24,000 square feet of new public space that would serve as a new home for community events and programming.

- 1 million square feet of retail, commercial, and industrial space that will produce hundreds of new jobs for East New Yorkers.

The plan for Herkimer-Williams draws upon numerous community planning studies and surveys over the years that highlighted the type of improvements desired at Broadway Junction. Among these, the ENY Neighborhood Plan and 2016 rezoning was expected to yield 6,500 homes by 2030. As of March 2023, only 596 units, of which just 157 are affordable, had been completed in the rezoned area. No new housing has materialized in Broadway Junction.

QUICK LINKS

Skip scrolling, find the biggest stories here:

Around Kings County

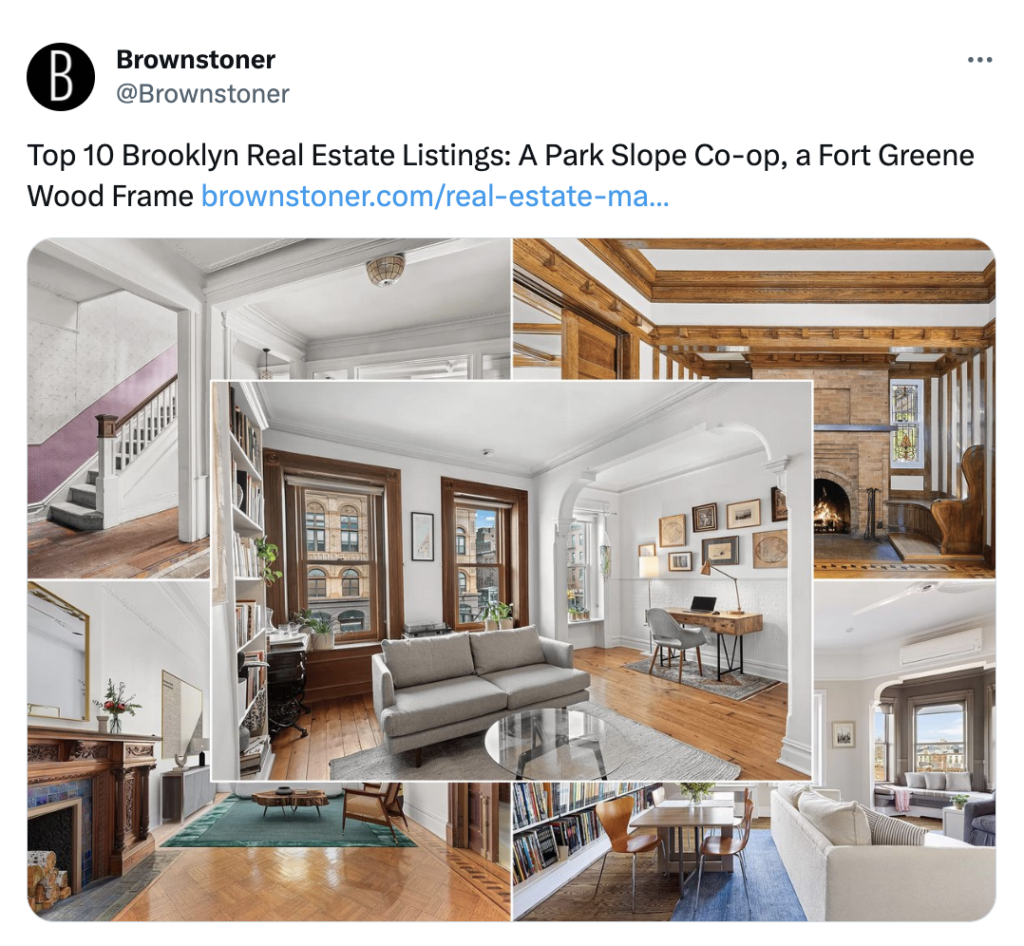

Church Sites Make Ripe Targets as Developers Flock to Bedford-Stuyvesant

A row of religious buildings in Bedford-Stuyvesant continues to draw developers, as churches remain challenged by dwindling congregations and steep maintenance costs — and as their ample air rights give off a tantalizing aura. The most recent arrival to Willoughby Avenue is Watermark Capital Group, a Brooklyn firm that has capitalized on church sites before. In November, Watermark closed on the $12.3 million purchase of St. Lucy’s-St. Patrick’s, a block-long multi-building site between Kent Avenue and Taaffe Place, and the developer recently set up scaffolding around the Catholic prewar site as it waits for approvals to demolish it.

Atlantic Yards at 20: Unfinished and Facing Foreclosure

Two decades ago, developer Bruce Ratner revealed a visionary $2.5 billion plan to create Brooklyn’s most celebrated project since its iconic bridge opened in 1883. The launch party, on Dec. 10, 2003, was attended by legendary Brooklynites like Jay-Z and former Knicks forward Bernard King. The project may have started with a bang, but it’s looking like it may go out with a whimper. Twenty years on, the project is unfinished, and one of its lenders just kicked off foreclosure proceedings.

Governor Hochul Announces Start of Construction on Clarkson Estates

CAMBA Housing Ventures’ $238 million affordable and supportive housing development Clarkson Estates, which is part of the State’s $1.4 billion Vital Brooklyn initiative began construction last week. The project will feature 328 affordable apartments, including 164 supportive units for formerly homeless households, CAMBA’s onsite supportive services, and over 30,000 square feet of community facility space in Flatbush, Brooklyn.

Jacob Schwimmer Converting Downtown Brooklyn office

A Downtown Brooklyn conversion was the highlight of last week’s commercial property sales in the city’s middle market, which The Real Deal defines as between $10 million and $40 million. An entity connected to JCS Realty paid $38 million for 540 Atlantic Avenue, Brooklyn. JCS filed plans this year for an eight-story, 15-unit building with ground-floor retail space. Jacob Schwimmer’s JCS plans to demolish a mostly empty, five-story office building on the site.

NYCHA and Partners Secure $635.6 Million For Renovations Across East Brooklyn

The New York City Housing Authority and its partners have reached a significant milestone by closing on a $635.6 million PACT project aimed at renovating 87 buildings in East Brooklyn. This comprehensive initiative will benefit nearly 3,500 residents, providing them with upgraded apartments, public spaces, grounds, and building infrastructure.

Housing Solutions From

Across The Globe

Photo: Cedric Letsch/Unsplash.

California is Desperate for Affordable Housing but Can’t Stop Getting in Its Own Way

In Los Angeles, 49 units are taking 17 years to build, facing nearly every hurdle that state laws allow. A Los Angeles nonprofit was given government land in January 2007 to build a few dozen units of affordable housing. They’re finally hoping to open the building next year. Lorena Plaza, a 49-unit development rising in the predominantly Latino neighborhood of Boyle Heights in eastern Los Angeles, is taking longer to complete, a city official said, than practically any other residential building this size in the history of Los Angeles.

Photo: Roger Lipera/Unsplash

Perspectives From Brooklyn

And Beyond

► The Housing Issues Most Likely to Dominate the 2024 New York Legislative Session

Next year’s session will be complicated by a big budget deficit and looming elections. But Governor Hochul is expected to take a second run at passing her housing plan after it fizzled last year. But she’s also dropping a controversial part of her plan to mandate housing construction after it faced intense opposition from suburban lawmakers who bristled at the idea of the state taking away local zoning control. “Good cause” eviction will likely return to Albany for a third year in a row as housing advocates plan to push for increased tenant protections – setting up a showdown with the real estate lobby. Sponsored by state Sen. Julia Salazar and Assembly Member Pamela Hunter, it would place limits on when a landlord is legally allowed to evict a tenant and would effectively place a cap on rent increases for apartments that aren’t rent-stabilized. Progressives last year said they would not accept any housing package without “good cause” eviction – and they didn’t, because a housing package didn’t pass.

Renewing or replacing the expired 421-a tax break for developers in New York City will likely be discussed next year. Hochul had originally proposed a replacement in 2022 when the program was set to expire, but lawmakers rejected it. Last year, she proposed a more modest extension for existing projects, which also did not make it through the Legislature. With the right labor protections, renewing the program has support from construction unions and developers contend the tax break is necessary to build more housing in New York City, while opponents said it doesn’t create enough affordable housing. State Sen. Jeremy Cooney also said he would like to see a return of the upstate version of 421-a that the governor proposed last year. Read more.

► Senate, House Announce Workforce Housing Tax Credit Act

Don’t tell Ronald Reagan, but the federal government is finally on its way to addressing the nation’s housing crisis. Amid the highest mortgage rates in two decades, a frozen transaction market for single-family homes, and nearly the highest rents ever seen, a bipartisan group of senators and representatives in Washington has introduced a new bill to encourage the construction of workforce housing for middle-income Americans. Read more.

► Adam Neumann Prepares to Launch First Flow Property

From 2010 to 2019, Adam Neumann led WeWork, where he tried to convince the world that his real estate company was actually a tech company. Neumann might not be at WeWork anymore, but he’s got a similar shtick with his new startup, Flow. The firm is set to officially launch its inaugural property early next year. The 639-unit property in Fort Lauderdale brings a tech-centric approach, the firm says. But critics say it’s little more than a traditional apartment management play, with the added commitment to fostering a more community-conscious, tech-driven environment. Read more.

► Fed Leaves Interest Rates Unchanged; Projects Cuts Next Year

The Federal Reserve voted unanimously at its Dec. 12-13 meeting to maintain the target range for the federal funds rate at 5.25% to 5.5%, the third consecutive meeting where rates were left unchanged, as noted in Ariel Property Advisors’ Capital Markets Monthly. And, if the economy evolves as expected, policymakers project multiple rate cuts beginning next year from a median fed funds rate of 5.4% at the end of this year to 4.6% at the end of 2024; 3.6% at the end of 2025; and 2.9% at the end of 2026. Read more.

► Blackstone, Rialto’s $1.2B bid Wins Signature CRE Loan Deal

Last week, the Federal Deposit Insurance Corporation awarded a stake in Signature Bank’s $17 billion commercial real estate loan pool to two Blackstone affiliates. Blackstone Real Estate Debt Strategies and BREIT partnered with Rialto Capital and Canada Pension Plan Investment Board on the deal. The FDIC retained an 80 percent interest in the venture and provided financing equal to 50 percent of the venture’s value, according to the winning bidders. The commercial real estate loan book holds 2,600 mortgages on retail, market-rate multifamily and office properties. The loans are predominantly performing and 90 percent are fixed-rate, according to Blackstone and its partners. Read more.

► Building Permits in NYC Continue to Slow, REBNY Finds

Foundation applications for new buildings — which show whether projects are actually moving forward with construction — continued to decline in November, which the real estate industry blamed on the lack of the 421a tax exemption and rising construction costs, according to data from the Real Estate Board of New York. New filings for foundations to build multifamily buildings slipped from 21 applications in October to 19 in November, with just one filing for a building of more than 100 units, according to REBNY. Those 19 projects have 557 proposed units, which is less than half of New York City’s monthly average for 2022. Developers filed only initial applications for 24 new building foundations per month on average this year, down from 55 in 2022. The total number of units proposed in those filings is also down 79 percent, from 45,162 apartments planned through November 2022 to 9,626 units during the same period in 2023, according to REBNY. Read more.

► Rent-Regulated Rego Park Building Sells for $48M

A fully rent-stabilized building in Queens’ Rego Park neighborhood traded hands for $48 million, providing another important data point for an asset class often described as troubled. The 312-unit Fannwood Estates was sold for about $153,000 per unit, brokerage Marcus & Millichap announced. The six-story property is at 99-19 66th Road, across the street from the Long Island Jewish Medical Center. Read more.

► Long Island Zoning Atlas Shows How Few Areas Allow New Apartments

A group of Long Island organizations has completed the labor-intensive task of compiling zoning data across the region’s more than 100 towns, villages and cities to create an online Long Island Zoning Atlas. The result is a map that shows the vast majority of Long Island allows for single-family homes, while new multifamily housing is allowed in only a slim fraction of those areas. Read more.

Brooklyn Space for Living, Working & Investing is produced by Eagle Urban Media. Contact at [email protected]

Copyright (C) 2023 by Eagle Urban Media. All rights reserved.

Leave a Comment

Related Articles

Good Food March 8, 2024

Brooklyn Space March 6, 2024

Good Food March 1, 2024

Leave a Comment

Brooklyn Boro

View MoreNew York City’s most populous borough, Brooklyn, is home to nearly 2.6 million residents. If Brooklyn were an independent city it would be the fourth largest city in the United States. While Brooklyn has become the epitome of ‘cool and hip’ in recent years, for those that were born here, raised families here and improved communities over the years, Brooklyn has never been ‘uncool’.

The Brooklyn Daily Eagle and brooklyneagle.com cover Brooklyn 24/7 online and five days a week in print with the motto, “All Brooklyn All the Time.” With a history dating back to 1841, the Eagle is New York City’s only daily devoted exclusively to Brooklyn.

© 2024 Everything Brooklyn Media

https://brooklyneagle.com/articles/2023/12/20/brooklyn-space-december-20-2023/